Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

Blog 11

Nick Mitterando

This week in the Nations textbook it discussed the crash of 2008 and 2010. The crash of 2008 was the biggest since the great depression and resulted in thousands of Americans losing jobs and struggling with money. The crash happened because too many people took out loans they could not afford. When it came time to pay the loans the people couldn’t, and the banks ran low on money because of this. This also ran house prices up extremely high and people could not afford them. The 2008 stock market crash destroyed 16.4 trillion dollars of people’s households’ net worth. The crash was caused by a bubble popping. This bubble was the housing bubble, many people saw real estate as profitable and invested in it. Then when it got to big it popped and the crash happened.

In 2010 there was another crash known as the flash crash. It only lasted 36 minutes. On May 6, 2010, the stock market opened, and Dow Jones was down, it then stayed that way for most of the day because of worries about the debt crisis in Greece. It then bounced back very quickly and righted itself by the end of the day. This was a very different crash than ones in the past because of how quick it was. Stock still dropped a huge amount like other crashes but it lasted only a fraction of the time.

Blog 10

Nick Mitterando

This week in the American Economy textbook there were no readings. Instead there was a chart and map to read and understand. Starting with the chart it shows “Washington Think Tank Calculates N.A.F.T.A.’s Impact on Jobs”. The chart compares 1993 trade, and 2000 trade with Canada and Mexico. It also shows the percent increase and the jobs gained or lost in the process. From viewing this chart, we can see that the percent went up in every category. Jobs were also gained in most categories. This chart does a very good job at showing the effects of N.A.F.T.A on U.S. trade with Canada and Mexico.

The next part of the reading was the map. The map gave a visual representation of NAFTA-related job losses since 1993 per state. From looking at the key we can tell there was a total of 786,030 U.S. jobs lost related to NAFTA. The key also shows us different shades representing different amounts of jobs lost per state. The most jobs lost were in Texas, California, Florida, and a few more states that had similar loss numbers. The least jobs lost were more in the south with states like Idaho, Wyoming, New Mexico, and Montana. This map gives a very detailed and easy to look at and interpret view of the data. Every state is accounted for and the data is easy to match to the key. This is a very good map to look at to understand the topic being explained.

This week in the Nations book the topic was the Crash of 1987. This crash was also known as Black Monday. It was the largest one-day percentage drop in the history of Dow Jones. It dropped a total of 508 points. So many people were trying to move money that the computers that ran the stock market systems started to crash and transfers would take hours at a time. This is known as one of the biggest crashes in modern history.

Nick Mitterando

Blog #9

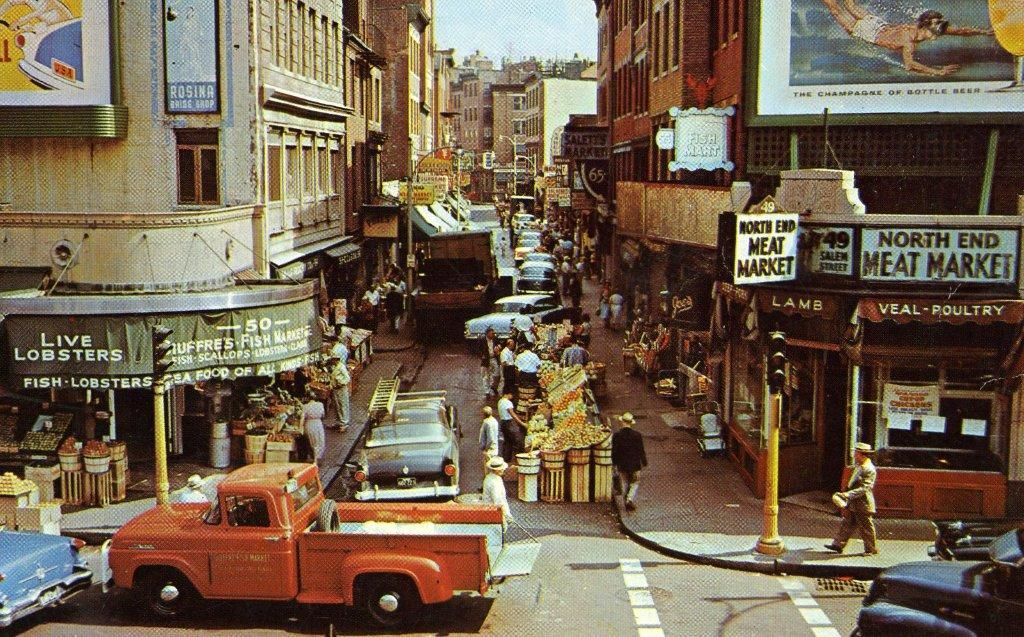

The first reading talked about the Downtown development of Boston. It explains how Boston was trying to redevelop into a better more modern area with a new and stronger economy. Many new stores and buildings were built to encourage people traveling, living, and spending money in Boston to boost the local economy. One example of this is in the reading when it says, “the enormous and architecturally acclaimed Kallman, McKinnell & Knowles Boston City Hall—had no cafeteria or dining hall within it, to force employees to leave the premises and patronize local restaurants and other businesses.” What this means is that since the new workplace had no cafeteria employees had to go u tot small local business and support them by buying lunch. This helped boost the economy in the area. The article later talks about the effects of these new shops and towns on older department stores and how they had to merge and close in order to adapt to the new area.

The second reading talks about the changes that happened to the south in the 50s-60s. Many farms and factories during and after WWII changed to be fully mechanized. The government was giving out contracts for Steel, Rubber and Space products production. Many of these factories and farms switched to be mechanized so they can support the production of these government contracts. This helped boost the profits and economy of the southern factories and farms. The reading ends by talking about how federal policy can be very biased. There is also an example from the civil war saying, “Once the Republican party gained power, they pushed through an unabashedly sectional economic development program that reinforced the South’s colonial status for decades after the Civil War.” This shows how federal policy can benefit certain areas more than others. Both articles show how important a stable economy is to any part of the nation, whether it is the nation as a whole or a small town.

Blog 8

Nick Mitterando

The first reading talks about the effects of the great depression on America for many years. Bernstein starts by saying how no economical event has been as big as the great depression. He then goes into the effects of it on industry and people. Starting with the secular transition that was abruptly ended by the depression. The transition was started but it was in a venerable stage still when the depression hit, and it died off. After the depression there was a shift in consumer demand. Many businesses failed to keep up with this shift while others did okay. “Certain major industries such as textiles, iron and steel, and lumber saw their markets weaken: others, notably appliances, chemicals, and processed foods, faced a new set of opportunities, but were not yet sufficiently strong to sustain a high rate of macroeconomic growth.” He ends by talking about the effects of World War II. World War II saw many changes in economic sectors. Many old economic sectors came back and new industries were invested in because of government help. Getting through the war was not easy but it resulted in a boom afterward.

The second article by Walter Greason talks about the path to freedom in the United States. He starts off by explain how Family and Community are the foundations of how people develop and learn in life. He then leads into how people wanted to seek new horizons and get white collar jobs, dive nice cars, and have big homesteads. This dream is what made people start migrating to different areas of the US. People were in search of their dreams and wanted to accomplish them any way they could. Later Greason talks about how old professions like sharecropping were left behind as people migrated to new lines of work. African Americans who previously were sharecroppers now got jobs as day laborers and live in domestics. They also set up The National Association for the Advancement of Colored People and the National Urban League, these were formed to encourage education and religion. He ends by talking about how these foundations along with new ways of living allowed for African Americans to have dreams for the first time in centuries.

The Nations book this week discussed the 1929 crash. This crash was what casued the great depression. At the time it was the biggest crash to ever hit the united states. Becasue of this crash the great depression lasted 10 years and would effect almost every person in america.

Blog 7

Nick Mitterando

The first reading is about the economy of World War 1. It opens with a very interesting quote saying that “The total cost of World War I to the United States (was) approximately $32 billion, or 52 percent of gross national product at the time.” This shows just how big of a financial strain a war of this scale could have on a country. The US was in a recession before the war, but it was taken out of it by a 44-month long boom. This resulted from other countries buying US goods for war. The US stayed neutral for as long as possible resulting in very good economics. We joined in 1917 and federal spending went up a ton. Many civilian manufacturers were re tooled for war efforts. Unemployment went down also. As part of the war the US tried to guide economic activity with centralized price and production controls. This ultimately didn’t help much. Another thing that was tried was the use of ratings for how urgent goods were to be produced. Unfortunately, everyone gave themselves an A rating, so this did not work either. He ends by saying how after the war there was the deprecation and many years of the government cleaning up the economy and fixing things.

The second reading talks about DuPont’s impact from world war 1. He starts by talking about the effects of the war on advertising. He later says, “This type of advertiser—he who is always building a commercial structure, rather than making temporary sales—is one of the great steadying factors that sustain the business morale of a nation during periods of stress.” What he means by this in my opinion is someone who is building up and preparing is the one who succeeds during hard times. He later says how America has not prepared enough for war and it shows with our losses of allies and deaths. Whereas a country like Germany should have been out of the war for years but is still in due to preparing. Later he goes into Germanys use of propaganda and how it relates to advertising. He ends by saying how as a country we must prosper as a whole in order to prosper as individual advertisers. He also says how the more we build up and prepare the more ready we will be.

Blog #6

Nick Mitterando

The first reading talks about how Carnegie became a partner of Keystone Bridge Company. It opens by talking a bit about Carnegies other partnerships and how he continually made money off his dividends. The Keystone Bridge Company wanted to use Carnegies steel lot make new and better bridges. These would replace the fragile wood one they currently use. Carnegie held a 1/5 share. The company did well during the civil war and did even better after it.

The second reading is about Henry Demarest exposing the Standard Oil Company. It starts out by talking about the nations extreme use of kerosene. He then goes on to say how the oil prices and the entire production and selling line is controlled by one company. The standard Oil Co. refines 9/10 of the oil in the world and controls the same amount in some way. Standard also owned many of the railroads in the US. This allowed them to charge almost anything they wanted for use of the railroads and access to New York harbor. He later goes more in depth of how much each family in the US is paying the Oil company and how much money the Standard really has. He ends by comparing the Pennsylvania oil basin to one in Germany and explains how partnership between oil companies and railroads would not be possible over there.

The final reading talks about Teddy Roosevelts 1901 speech. HE opens by speaking on how our current laws are not enough to regulate the big corporations anymore. He said that they were enough at one time but are now simply too outdated to keep people safe and fair. He later talks about how the big trusts need to be more closely supervised in order to keep them fairly and ethical. He claims that I the interest of the public the government should be able to supervise and work with these big companies. He ends by saying how when the constitution was adopted no one could see these big changes coming and that times change and so should laws.

Blog #5

Nick Mitterando

The first reading talks about James Henry Hammond and his time as a plantation owner. Hammond started out as a plantation owner who mainly grew and sold cotton. In 1831 Hammond quickly became one of the wealthiest men in the state owning over $90,000 in assets. However, his yield over the next four years would be only $775. He would try many things to fix this, but things only got worse as cotton prices dropped even lower in the coming years. Cotton was only worth about 6-7 cents per pound during this time which made profit close to impossible for Hammond. This was until he discovered the use of fertilizer. He went through many tests and experiments for his fertilizer and ended up with up to 50% more yield from cotton. With cottons prices staying low in 1845 he made the switch to corn as his main crop. As cotton prices rose again, he made the switch back to cotton. Hammond ended his career of making the plantation as efficient as a factory by purchasing a ton of swamp land for a very good deal. Here he would continue to experiment and grow corn and cotton. He had to first clear the 170 acres to make the land farmable, but it would prove to be worth it in profits.

The second reading talks about the business aspect of slavery and the rise of capitalism. The reading says how the early American economy was built primarily on slavery. As the economy evolved so did slavery. “Hands that drew bills of exchange, graded and traded commodities, or trimmed the sails of merchant vessels were as important to the process of slaving as hands that picked cotton or those that grabbed hold of whips, grasped the throats, or groped the loins of African-descended captives.” This shows how almost everything in America was based around slave labor. In 1808 enslaved people were the main category of property that were not allowed to be passed through borders. The slave trade was horrible and often deadly for slaves. While slaves were being mistreated and overworked America was getting richer and more evolved. None of this in my opinion is fair and the author sums it up well by saying “The slavery business thrived on intergenerational theft, displacement, humiliation, and misery”.

Blog #4

Nick Mitterando

The first reading was “Factory Girl” in the textbook. In this reading we go along on a tour of an 1800s factory as a little girl. The reading goes into detail about every part of the factory. It paints a very detailed picture in your head of what the factories are like. During the explanation of each part of the factory we can see the terrible conditions like mud on the floors, smoke filled rooms and sky, and dangerous machinery. It is said to the girl multiple time to “Watch her step” because the machines are so dangerous and open one can get killed. Overall this reading does a great job of explaining the terrible and dangerous conditions of the factory, and just how brutal it was to work in one.

The second reading was by the New York Times. It talks about modern day business practices and capitalism and how it has many roots in slavery. It starts by talking about a businessman who raised the price of a needed drug by over 52 times, when asked why he said capitalism. Many believe that this idea was first started on the plantations in the south with slaves. One quote that stood out to me was about how modern-day work feels and how it is similar to years ago in slavery. “You report to someone, and someone reports to you. Everything is tracked, recorded and analyzed, via vertical reporting systems, double-entry record-keeping and precise quantification. It feels like a cutting-edge approach to management, but many of these techniques that we now take for granted were developed by and for large plantations”. The article ends by saying how the culture of getting rich without working hard has been responsible for slavery, the panic of 1837, both recessions, and much more.

The reading starts off with a statement made by Eli Whitney. Whitney in this statement explained his view on how industrialization should work in the US. His main important points were the prerequisites for mass production, as well as explaining the process of taking small parts to make one final product. He also wanted the work to be done by unskilled or low skilled workers. If this process sounds familiar it is because almost every major manufacturing company would use it, one day. People like Henry Ford would even go on to use these core principals. He would later go on to complete an order of 1000 Colt Six-Shooters. He used unskilled labors who followed patterns and outlines to make small parts that would become each gun.

One thing I found very interesting was that he never patented any of his inventions. He invented and borrowed many machines that were used in the production process. It was said that “He kept neither the results nor the methods secret. He never bothered to patent any of his machines, and he communicated freely with other arms manu- facturers,” This in my opinion helped move the country as a whole towards an industrial revolution. Anyone could use his process and machines for free which allowed for many companies to automate processes and have competition. It was said how later on many British inspectors and overseers were shocked at the relation between employee and employer as well as the equipment being used for production.

-Nick Mitterando

Blog 2

Nick Mitterando

This reading was by William M. Gouge Decries. Decries starts out by voicing his strong opinion on banks in America. His first claim states that whatever power corporations have, has at one point been taken from the people or government. This gives us a good idea on his views for the rest of the reading. Decries has a very strong opinion towards banks and corporations in general. “They are exempted from liabilities to which individuals are subjected” he says. What Decries means by this is that corporations are safe from certain problems that face individuals. His example of this says how when a man can’t pay his taxes or bills, he is hunted by a creditor, the creditor then takes his belongings to pay. Whereas with a bank or corporation, when they can’t pay the problem falls on the people who put their money into it.

He later says how he does not like how the banks are printing money now instead of the government. This is proved in his quote “They coin money out of paper. What has always been considered one of the most important prerogatives of Government, has been surrendered to the Banks.” Decries does not like how much power and how little liability the banks have in America. He ends by making an interesting connection to Lords in England. He says how in England Lords are given special privileges and are exempt from certain problems other people face. He then says how the equivalent of this in America is banks. I believe this shows how upset he is with the banking system and cooperation’s as a whole. In the early days it must have been hard to trust that your money was safe in the bank. Given the time period this was written I can understand his concerns.

-Nick Mitterando